9: Getting paid!

Know your award

Awards set out minimum rates of pay and entitlements for whole industries. When you get a job make sure to check which award covers your industry and what it entails. Even if your industry is not covered by an award you are still protected by the National Employment Standards.

As a young employee, you might get a lower pay rate because of your age. People under 21 years old can be paid junior pay rates

– a percentage of the full rate that increases as you get older.

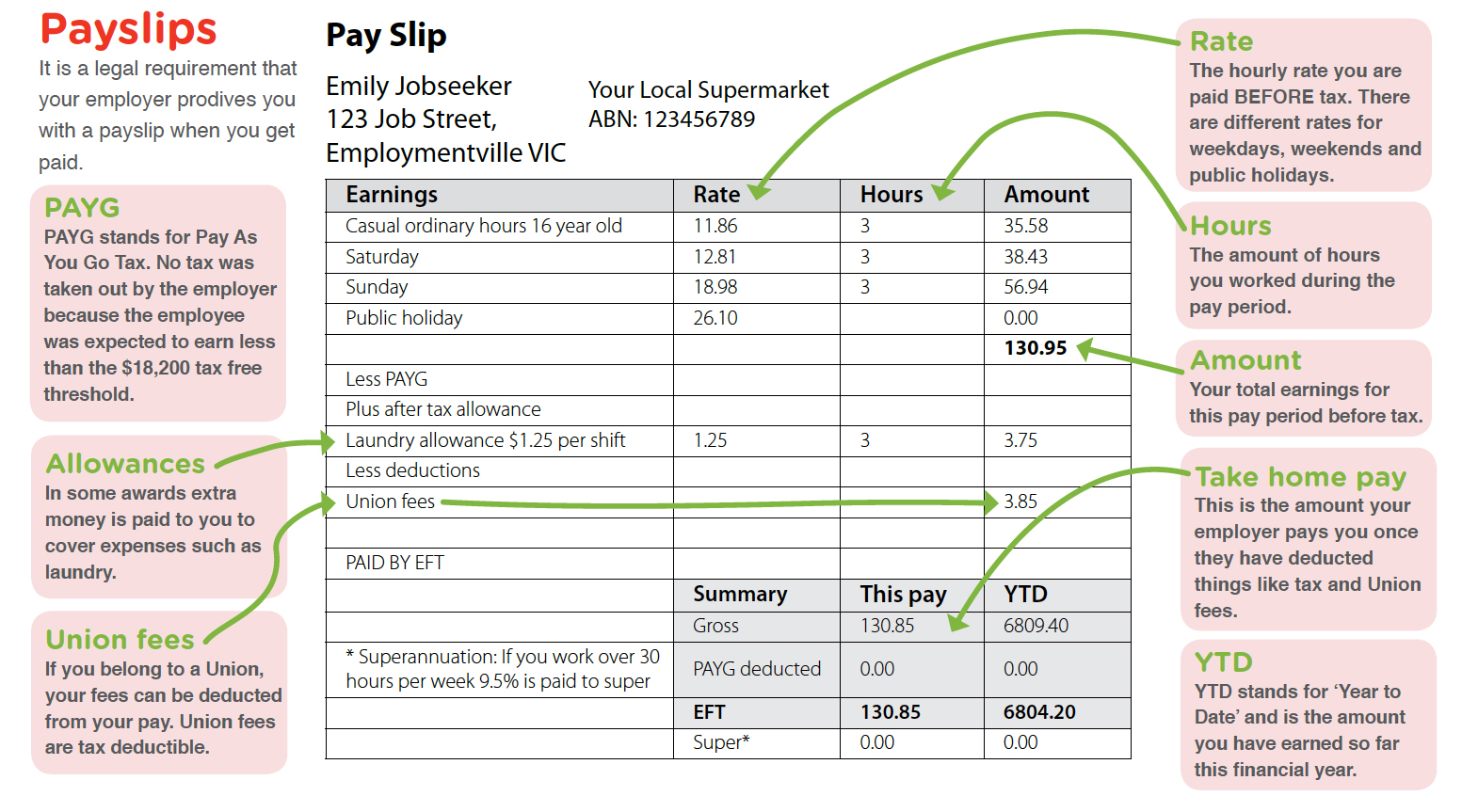

Understanding your payslip

When you get paid, your employer has to send you a pay slip containing details of your payment. Among other things, it has to include how much you’ve been paid, the period you were paid for, tax details, and superannuation details.

Click on the image to enlarge.

Understanding tax

Your employer will withhold some of your pay as income tax – this is called Pay As You Go (PAYG) Withholding. Then at the end of the financial year your employer will give you a payment summary,

so that you can complete a tax return for the Australian Tax Office. If the amount you earned is under the tax-free threshold you’ll be refunded everything that was withheld.

Understanding superannuation

Superannuation is money that is taken out of your pay and put into a fund for when you retire.

If you’re under 18, earn $450 or more (before tax) in a calendar month, and work more than 30 hours in a week, your employer is required to make contributions to your superannuation account.

The Cash Trick

Getting paid in cash for your hard day’s work can seem like magic…

Some businesses use cash payments to employees, so that they can avoid paying tax, superannuation and other entitlements to their workers.

- Understand your award and what it entails

- Understand your payslip

- Stay on top of tax and super